President Joe Biden has alerted college students across the country with his student loan forgiveness plan, which would give students between $10,000 and $20,000 toward paying college loans depending on their yearly income. Sounds great, right? So why all the pushback?

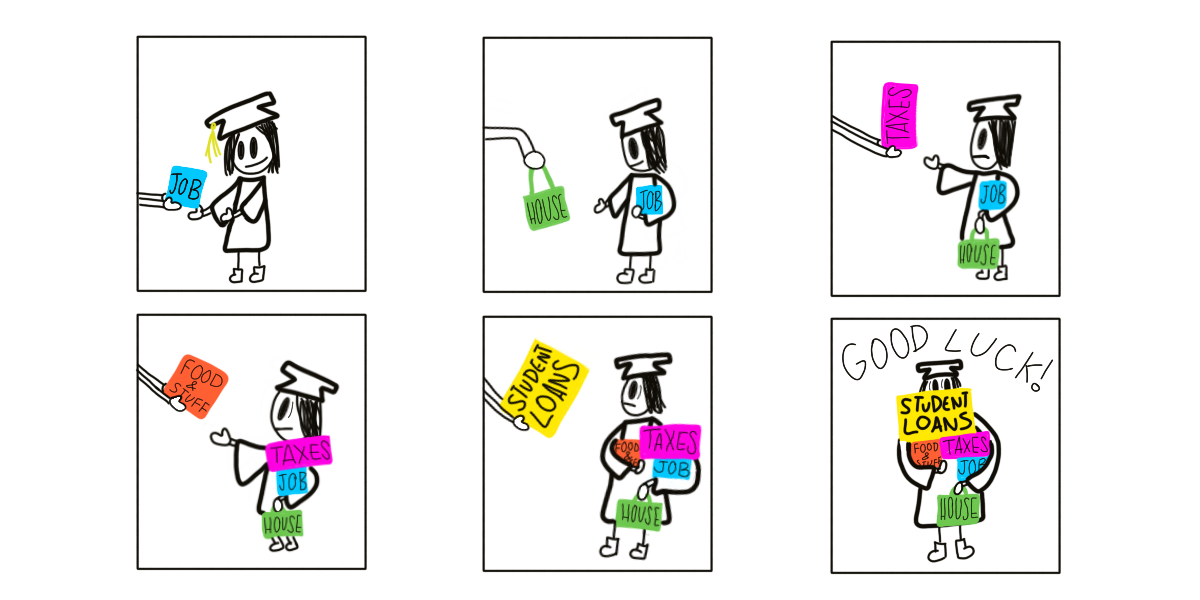

Students often struggle after college, finding an overwhelming amount of debt waiting for them in addition to a new job and the responsibilities of living on their own. The Biden administration’s student loan forgiveness program attempts to solve this. Graphic created by Isabel Rinkenberger

__________________________________________________

Americans owe more than $1.75 trillion in student loans. In 2020 alone, over 55% of all bachelor-degree-earning college students in the United States graduated with an average student loan debt over $28,000. Helping those who are struggling to pay back the money they borrowed to better their job prospects through a college education seems like a good idea – a great idea even. Everyone loves free money, and it would benefit graduates who are struggling to stay afloat and pay off interest-accruing loans at the same time. So why is there so much debate surrounding the president’s proposal, to the point where lawsuits have even been filed due to President Biden’s use of national emergency powers to enact the law? Also, income taxes could be added onto the loan forgiveness clause in some states. For example, a loan forgiveness in the amount of $10,000 could be taxed, often at a rate of more than 30%, so while the loan would go away the borrower would suddenly owe more than $3,000 in income taxes. For 43 million Americans in debt after attending college, with loans demanding a notable chunk of each month’s paycheck just to cover rapidly accruing interest on top of an already-massive loan principal, the debilitating load could be lightened or paid completely through the student loan forgiveness plan. President Biden’s plan seems to be a breath of fresh air in an environment saturated with debt as the United States itself is also struggling with almost insurmountable debt. Many misconceptions make this a contentious topic among Republicans and Democrats alike. First, not everyone qualifies. Only individuals making less than $125,000 a year – or households making less than $250,000 a year – would be able to receive the government-issued funds. While there are over 48 million Americans in college debt, only 43 million are expected to qualify, meaning over 5 million people will not benefit from President Biden’s plan. Students can take out two kinds of loans: federal and private. Federal loans are administered directly through the government, often coming with a fixed interest rate and payment plans based on the individual’s income. Private loans are less common with only 7% of students opting for the loans via private companies like banks or online lenders. Only federal loans are eligible for repayment through the president’s plan, limiting those affected once more. Third, the money has to come from somewhere. The estimated price tag to achieve President Biden’s promise is $400 billion. While it may be easy as a citizen to tack on $400 billion to the United States’ $30 trillion debt and write it off as the government’s problem, it can only come back to bite us. If the U.S. government continues to spend as it has been, there is a possibility the country will default on its own loans, meaning there is no conceivable way of repayment, which could lead to higher interest rates for the world and a deeper economic recession. To avoid this looming catastrophe, the government can either decrease spending or increase taxes. Supporters of the student loan debt forgiveness plan advocate for increasing taxes on the wealthy and large corporations to avoid heaping more costs on lower-income groups. However, opponents of the bill argue this will lead to higher inflation, which will only hurt those President Biden’s plan aims to help. A federal judge in Texas became the most recent block in the road for the Biden administration’s plan, on Nov. 10, declaring it illegal for the president to sign it into law without congressional support. Following this decision, the student loan forgiveness program has been suspended for the time being, freezing the applications of more than 26 million Americans and denying submission of any new applications. When presented with the facts, where do you stand on this seemingly too-good-to-be-true legislation?